For every Pakistani traveler with a dream of wandering through the historic streets of Paris, sailing the Greek Isles, or exploring the Swiss Alps, there's a critical, non-negotiable step: obtaining Schengen Visa travel insurance. This isn't just paperwork for the embassy; it's your financial safety net in a foreign land.

Whether you've opted for a policy from a popular local provider like Adamjee or UIC (United Insurance Company), or you've chosen to book online with an international insurer, understanding the claim process is vital for a smooth journey. When the unexpected happens, you shouldn't have to face the challenge of complex European healthcare costs alone.

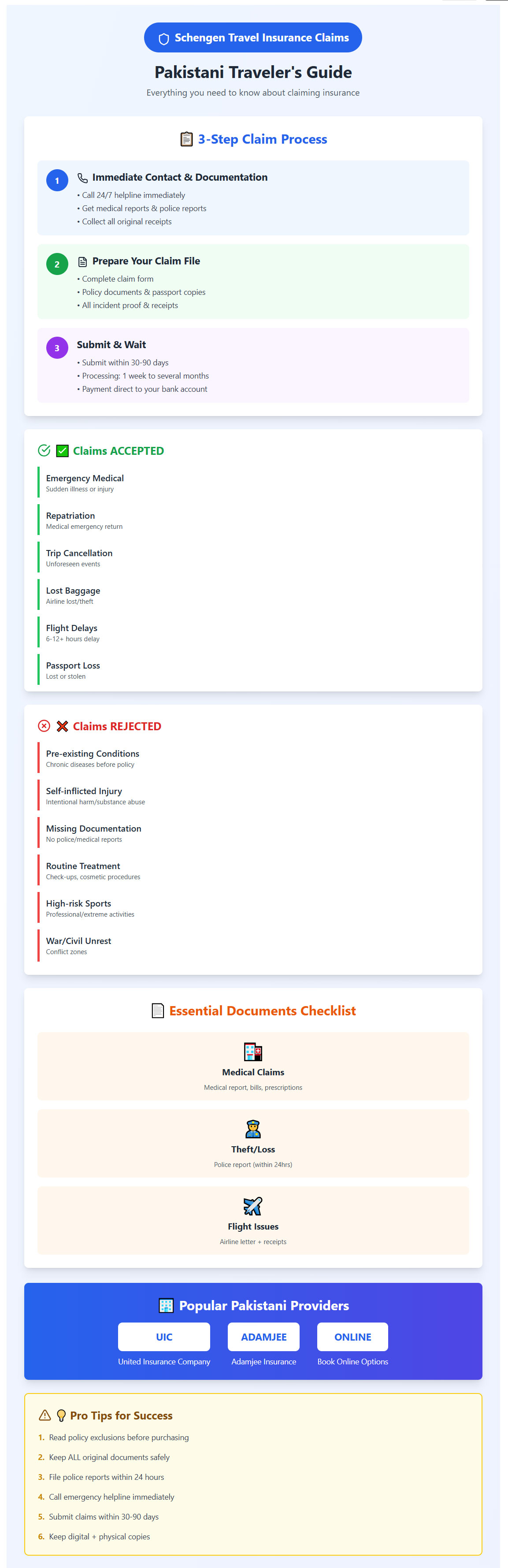

The Step-by-Step Schengen Insurance Claim Process from Pakistan

Making a claim can feel daunting, especially from a foreign country, but your insurance is designed to help. The process, while varying slightly between providers, follows a core set of steps.

Step 1: Immediate Contact and Documentation (The Moment of Truth)

This is the most crucial step. As soon as a covered incident occurs—be it a sudden illness, an accident, or loss of luggage—you must:

- Contact your Insurer's 24/7 Helpline: Every reputable Schengen travel insurance provider, including those in Pakistan, offers a worldwide emergency assistance number. Call this number immediately for major incidents like hospitalization or emergency medical evacuation. They will guide you on direct settlement with the hospital, eliminating out-of-pocket costs.

- Gather All Evidence: Never leave a situation without a paper trail.

- Medical Claims: Obtain a detailed medical report, doctor's notes, original hospital bills, and prescription receipts.

- Theft/Loss: File a police report within 24 hours of discovery (e.g., for passport or luggage theft). Get a copy of the official report, as this is non-negotiable.

- Flight/Trip Delay/Cancellation: Get a written statement or email from the airline/carrier confirming the reason and duration of the delay/cancellation. Keep all receipts for food and accommodation incurred due to the delay.

Step 2: Preparing Your Claim File (The Paperwork Trail)

Once you are back in Pakistan or stable during your trip, you must compile your claim file to submit to the local office (e.g., Adamjee or UIC) or submit the claim through their online portal. The file typically includes:

- Completed Claim Form: Available on your insurer's website or local branch.

- Original Policy Documents: A copy of your Schengen insurance certificate.

- Original Passport & Visa Copies: For verification of travel dates and entry/exit stamps.

- Proof of Incident: All the documentation gathered in Step 1 (e.g., medical reports, police report, airline letters).

- Original Receipts: For all expenses you are claiming reimbursement for.

Pro-Tip: Many companies offer the option to book online and file claims via an app or email. Even if you submit digitally, keep the original physical copies safe until the claim is settled.

Step 3: Submission and Processing (The Waiting Game)

Submit the complete claim file within the timeframe specified by your policy—this is usually 30 to 90 days from the date of the incident or your return to Pakistan.

- Your insurance company will review the documentation.

- Simple claims (like minor delays) may be processed quickly (within a week).

- Complex medical or repatriation claims may take a few weeks to several months.

- The insurance company will directly transfer the approved amount to your bank account in Pakistan.

Scenarios Where Your Travel Insurnce Claim is Likely Accepted (Covered Incidents)

Your Schengen travel insurance policy is designed to cover unexpected, non-routine, and sudden events that disrupt your trip. Here is a list of the most common and generally covered scenarios:

| Category | Covered Scenario | Required Documentation (Key to Claim) |

|---|---|---|

| Emergency Medical | Sudden illness (e.g., fever, food poisoning) or injury requiring emergency treatment or hospitalization. | Medical report, original bills, doctor's prescription. |

| Repatriation | The necessity to be flown back to Pakistan due to a serious medical emergency, or repatriation of mortal remains. | Doctor's certification of medical necessity, insurer's pre-approval. |

| Trip Cancellation/Curtailment | Inability to start or continue your trip due to a severe and unforeseen event (e.g., death in the immediate family, personal sudden illness/injury, or unexpected job loss). | Death certificate, doctor's note, employer's letter, proof of non-refundable expenses. |

| Loss/Theft of Baggage | Permanent loss or theft of checked-in baggage by a common carrier (airline). | Police report (for theft) or Property Irregularity Report (PIR) from the airline. |

| Flight Delay | Significant delay (e.g., over 6 or 12 hours, depending on the plan) leading to essential expenses like meals or accommodation. | Airline's official letter stating the reason/duration of delay, original receipts for expenses. |

| Loss of Passport | Passport lost or stolen during the trip, requiring emergency funds for replacement. | Police report filed immediately. |

Scenarios Where Your Claim is Likely Rejected (Common Exclusions)

Understanding exclusions is just as important as knowing what is covered. Most policies, whether from Adamjee, UIC, or others, have universal clauses that can lead to an instant rejection.

1. Pre-Existing Medical Conditions

Any sickness, injury, or medical condition that you had before the start date of your insurance policy will generally not be covered. This includes chronic diseases like heart conditions or diabetes unless you have purchased an extremely specialized and high-premium plan that explicitly includes a waiver for these.

2. Intentional & Self-Inflicted Acts

- Claims arising from self-inflicted injuries, suicide attempts, or drug/alcohol abuse.

- Injury sustained while participating in professional sports or extremely dangerous, high-risk activities not specifically covered (e.g., base jumping, unguided mountaineering).

3. Lack of Documentation

This is the most frequent reason for denial for Pakistani travelers. If you cannot provide a formal Police Report for theft, or an official Medical Report (just a receipt isn't enough), your claim will be rejected.

4. Routine/Elective Treatment

Claims for routine check-ups, cosmetic procedures, non-emergency dental work, or obtaining new eyeglasses are not considered emergency medical events. Similarly, travel for the primary purpose of seeking medical treatment is excluded.

5. War, Civil Unrest, or Nuclear Events

Any loss arising from acts of war, invasion, civil commotion, or radioactive contamination is universally excluded from standard travel policies.

6. Failure to Contact Assistance

In a major medical emergency, if you are able to, and you or a family member fail to call the 24/7 emergency line and the insurer was not able to coordinate the treatment and costs, they may reject or partially pay the claim. They must have the chance to approve major expenses.

Final Advice for Pakistani Travelers

Purchasing Schengen travel insurance is an investment in peace of mind. To secure your journey:

- Read the Fine Print: Before you purchase—whether it's an online transaction or from an agent—understand the specific exclusions of your chosen plan.

- Keep Originals: As you travel, treat every receipt, medical report, and official document as a treasure. Original documents, especially those stamped by a European hospital or police station, are gold when submitting your claim back in Pakistan.

Your adventure awaits, and with the right insurance, you can explore the beautiful Schengen zone with confidence, knowing you have a reliable team back home, be it Adamjee, UIC, or another provider, ready to assist when you need it most.

;More Travel News

-

15-Aug-2025Visa-Free Entry to America in 2025: A Comprehensive Guide to the Visa Waiver Program (VWP)

15-Aug-2025Visa-Free Entry to America in 2025: A Comprehensive Guide to the Visa Waiver Program (VWP) -

01-Feb-2022Top Airports in Pakistan in terms of Passenger Traffic

01-Feb-2022Top Airports in Pakistan in terms of Passenger Traffic -

01-Jun-2022Pakistan Government has announced Hajj policy 2022 with subsidy

01-Jun-2022Pakistan Government has announced Hajj policy 2022 with subsidy -

21-May-2025The UK Visa Financial Requirements: A Comprehensive Guide for Work, Study, and Visit Purposes (Effective May 2025 Onwards)

21-May-2025The UK Visa Financial Requirements: A Comprehensive Guide for Work, Study, and Visit Purposes (Effective May 2025 Onwards) -

11-Oct-2024Umrah on budget: Tips to Save Money without Compromising the Experience

11-Oct-2024Umrah on budget: Tips to Save Money without Compromising the Experience -

25-Aug-2023Saudi Arabia and Pakistan Forge New Agreement to Enhance Pilgrim Experience and Ease Costs

25-Aug-2023Saudi Arabia and Pakistan Forge New Agreement to Enhance Pilgrim Experience and Ease Costs -

07-Mar-2025Spring into Adventure: Family Travel Deals

07-Mar-2025Spring into Adventure: Family Travel Deals -

14-Sep-2020Saudi Arabia To Ease COVID-19 Travel Restrictions After 1st January 2021

14-Sep-2020Saudi Arabia To Ease COVID-19 Travel Restrictions After 1st January 2021 -

17-Jun-2020Changing In Travel Insurance Policies Due to Covid-19

17-Jun-2020Changing In Travel Insurance Policies Due to Covid-19 -

09-Oct-2025Gulf Countries to Launch “Schengen-Style” Visa

09-Oct-2025Gulf Countries to Launch “Schengen-Style” Visa -

08-May-2019Travel Insurance Ultimate Checklist

08-May-2019Travel Insurance Ultimate Checklist -

13-Sep-2024Riyadh Air Starts Test Flights - Will Launch Commercially From 2025

13-Sep-2024Riyadh Air Starts Test Flights - Will Launch Commercially From 2025