In a decisive move aimed at altering the trajectory of its aviation sector, the government has announced that it will sell 75% stake in national flag carrier PIA. This high-stakes divestment represents a significant shift from previous strategies, moving away from partial sales toward a structure that offers private investors comprehensive control. For a debt-ridden airline that has struggled with losses, mismanagement, and operational bans, the decision to sell 75% stake in national flag carrier PIA is being hailed by officials as the only viable path to a sustainable revival.

The upcoming bidding process, scheduled for December 23, 2025, marks the beginning of a phased exit for the state. While the initial offer is to sell 75% stake in national flag carrier PIA, the transaction includes a "green shoe option" allowing the successful bidder to acquire the remaining 25% later, effectively leading to a 100% privatization of the airline.

The Economic Catalyst: Why the Sale is Happening Now

The primary driver behind the move to sell 75% stake in national flag carrier PIA is the staggering financial burden the airline places on the national exchequer. With accumulated losses exceeding $2.5 billion, the status quo had become untenable under the reform pressures of the $7 billion IMF program.

Key Reasons for Privatization

Fiscal Bleeding: PIA has relied on billions in government bailouts for decades, draining funds that could be used for public infrastructure.

IMF Reform Pressure: Privatizing state-owned enterprises (SOEs) is a critical condition for Pakistan’s ongoing economic stabilization plan.

Operational Revival: The government lacks the capital required to revamp an aging fleet; hence, the decision to sell 75% stake in national flag carrier PIA aims to bring in private equity for modernization.

Transaction Structure: A New Deal for Investors

Unlike previous failed attempts, the current framework to sell 75% stake in national flag carrier PIA is designed to be "investor-friendly." Bidders demanded full managerial control, leading the government to increase the offered share from the originally planned 60% to a more substantial 75%.

Comparison of Previous vs. Current Privatization Attempts

| Feature | Previous Attempt (2024) | Current Plan (Dec 2025) |

|---|---|---|

| Stake Offered | 60% | 75% (with 100% option) |

| Investor Control | Partial/Shared | Complete Managerial Control |

| Cash to Exchequer | 15% of bid | 7.5% of bid |

| Reinvestment | Minimal | 92.5% injected into PIA |

| Debt Status | Integrated | Rs 654 billion parked in a holding co. |

The decision to sell 75% stake in national flag carrier PIA with such a high reinvestment ratio (92.5%) signals that the government's priority is the airline’s survival over immediate cash gains for the treasury.

Roadmap for the Future: Fleet and Route Expansion

The business plan accompanying the move to sell 75% stake in national flag carrier PIA is ambitious. By offloading management to the private sector, the government expects the airline to undergo a rapid transformation over the next four years.

Fleet Modernization: The plan aims to increase the number of airworthy aircraft from the current 18 to 38 by 2029.

Route Network Extension: PIA currently serves 30 cities. Post-privatization, this is expected to grow to 40 destinations, capitalizing on the recent clearing of international routes to the UK and Europe.

Branding Continuity: Despite the move to sell 75% stake in national flag carrier PIA, the government has stipulated that the name and branding of the airline must remain unchanged to preserve its national identity.

Shortlisted Bidders and Market Sentiment

As the December 23 deadline approaches, four major consortia have been pre-qualified to bid. These include industrial giants such as the Lucky Cement Consortium, Arif Habib Corporation, Fauji Fertilizer, and Air Blue. The high level of interest from these local powerhouses suggests that the move to sell 75% stake in national flag carrier PIA is viewed as a high-potential turnaround opportunity.

Potential Impact on Employees

While the prospect of efficiency excites economists, it brings anxiety to the airline's workforce. The government has assured that safeguards for workers' rights will be included in the final terms. However, history shows that such large-scale privatizations often involve "Golden Handshake" schemes to address overstaffing issues.

Conclusion: A High-Stakes Departure

The decision to sell 75% stake in national flag carrier PIA is more than just a financial transaction; it is a test of Pakistan's resolve to reform its economy. If successful, the privatization could serve as a blueprint for other struggling state enterprises. By choosing to sell 75% stake in national flag carrier PIA, the state is betting that private sector agility can restore the "Great People to Fly With" to their former glory.

Would you like me to create a detailed breakdown of the four pre-qualified consortia and their respective business backgrounds?

More Travel News

-

24-Nov-202530 Days Dubai Visa Price from Pakistan tourist Guide 2025-2026

24-Nov-202530 Days Dubai Visa Price from Pakistan tourist Guide 2025-2026 -

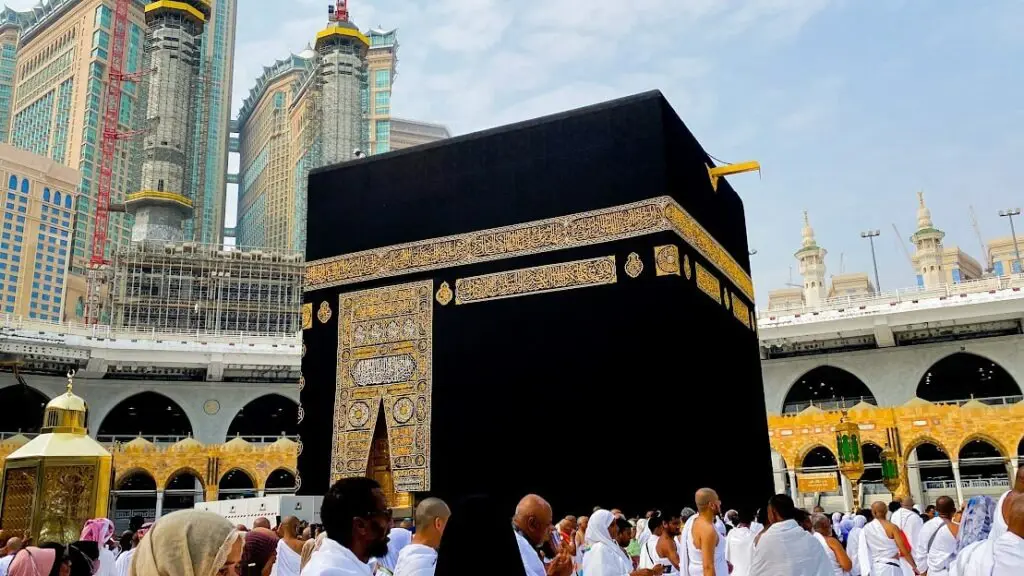

15-Jan-2026Ziyarat Places Added to Umrah Packages 2026

15-Jan-2026Ziyarat Places Added to Umrah Packages 2026 -

14-Apr-2020Explore The Facilities of Best Umrah Packages From Pakistan

14-Apr-2020Explore The Facilities of Best Umrah Packages From Pakistan -

11-Mar-2025Umrah 2025 Special: 15-Day Packages with Up to 20% Off

11-Mar-2025Umrah 2025 Special: 15-Day Packages with Up to 20% Off -

08-Apr-2025Saudi Arabia Imposes Travel Ban on Pakistan, India, and 12 Other Nations Amid Hajj Season: New KSA Visa Policy Takes Effect April 13, 2025

08-Apr-2025Saudi Arabia Imposes Travel Ban on Pakistan, India, and 12 Other Nations Amid Hajj Season: New KSA Visa Policy Takes Effect April 13, 2025 -

21-May-2021Saudi Arabia New Vaccine Conditions Bring Pakistani Travellers In A Trouble

21-May-2021Saudi Arabia New Vaccine Conditions Bring Pakistani Travellers In A Trouble -

29-Oct-2021List of countries that Indonesia Bali open to Tourists

29-Oct-2021List of countries that Indonesia Bali open to Tourists -

19-Oct-2019How Much Luggage Allowed for Umrah

19-Oct-2019How Much Luggage Allowed for Umrah -

.jpg) 20-Nov-202415 Banks Approved Hajj Application for the Year 2025

20-Nov-202415 Banks Approved Hajj Application for the Year 2025 -

.webp) 02-Jun-2025Hajj: A Sacred Pilgrimage – An Illustrated Guide to Its Essence and Common Questions

02-Jun-2025Hajj: A Sacred Pilgrimage – An Illustrated Guide to Its Essence and Common Questions -

06-Aug-2025The UAE's 5-Year Multiple Entry Visa

06-Aug-2025The UAE's 5-Year Multiple Entry Visa -

27-Jun-2019Top 10 Peaks in Pakistan

27-Jun-2019Top 10 Peaks in Pakistan