ISLAMABAD – In a high-stakes geopolitical move with both economic and strategic consequences, Pakistan’s decision to ban Indian-registered aircraft from its airspace has caused financial ripples on both sides of the border. However, data suggests that India’s aviation industry is suffering far more, while Pakistan’s losses, though measurable, are relatively modest and strategically calculated.

According to figures shared by the Ministry of Defence in the National Assembly, the Pakistan Airports Authority (PAA) has incurred a Rs4.1 billion shortfall in overflying revenue during the period from April 24 to June 30, 2025. This loss comes after Pakistan closed its airspace to all Indian-registered aircraft, including those operated, owned, or leased by Indian carriers. The closure followed India’s unilateral suspension of the Indus Waters Treaty on April 23—a move seen in Islamabad as a significant diplomatic provocation.

Background of the Airspace Closure

On April 24, Pakistan’s Civil Aviation Authority issued an immediate ban on Indian flights crossing its airspace. The decision targeted between 100 to 150 Indian aircraft daily, resulting in nearly a 20% drop in transit traffic over Pakistan.

The step was not without precedent. In 2019, following heightened military tensions, Pakistan imposed a similar airspace ban, which lasted for several months and resulted in estimated losses of Rs7.6 billion ($54 million). This time, however, Pakistan’s aviation sector appears better prepared to absorb the financial shock.

The Ministry of Defence emphasized that such decisions are not merely economic calculations but part of the country’s broader security and sovereignty measures. “When safeguarding sovereignty and security, no price is too high,” the statement read.

Why India is Losing More

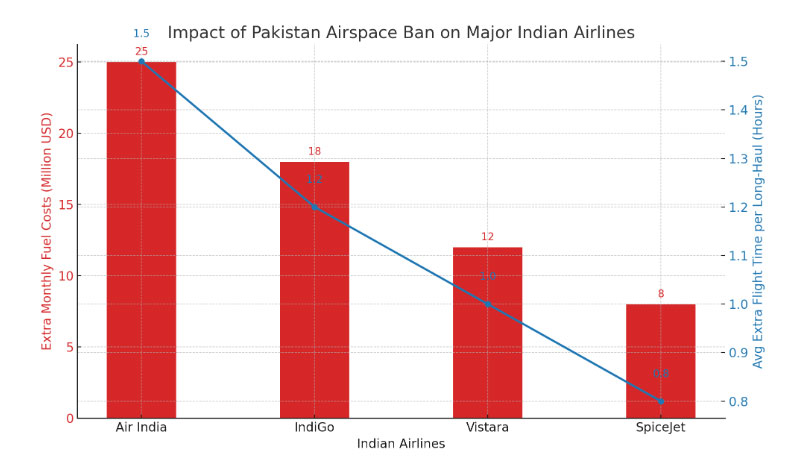

While Pakistan’s Rs4.1 billion shortfall sounds significant, aviation analysts point out that India’s national and private airlines are absorbing a much heavier blow. The closure forces Indian carriers operating long-haul routes—especially those to Europe, North America, and parts of the Middle East—to take longer, more expensive detours.

This rerouting leads to:

Increased fuel costs for each long-haul journey.

Longer flight durations, requiring more crew hours and higher operational costs.

Reduced passenger appeal on certain routes due to extended travel times.

The Indian aviation industry’s reliance on shorter, direct routes through Pakistani skies means the cumulative financial hit is several times higher than Pakistan’s revenue shortfall.

Impact on International Flights from Pakistan

For international flights from Pakistan, the airspace closure for Indian carriers has had limited operational disruption. Flights to the Middle East, Europe, and North America from cities like Karachi, Lahore, and Islamabad remain unaffected. However, routes involving India—already restricted since the initial ban—continue to face mutual suspension, meaning Pakistani carriers cannot enter Indian airspace either.

Despite the ban, passenger demand for international flights from Pakistan remains strong, particularly to Gulf destinations, Turkey, and Malaysia. Airlines have managed to maintain service continuity, and the government has refrained from increasing overflight or aeronautical charges, ensuring competitive ticket prices in the region.

Online Flight Booking Trends Show Stability

Interestingly, data from online travel platforms suggests that the ban has not dampened demand for online flight booking in Pakistan. Searches and bookings for routes to the UAE, Saudi Arabia, Qatar, and Europe remain consistent with pre-ban levels.

Travel agencies report that Umrah and work-related travel bookings are thriving, while student and business travel to Western countries continues to grow. In fact, some online booking portals have reported an uptick in early-bird international flight bookings, as travelers secure tickets well in advance to lock in competitive fares.

Airspace Closure at Islamabad International Airport

In a separate development, Islamabad International Airport has announced a temporary daily airspace closure from 11:00 AM to 1:00 PM until August 14. This measure, unrelated to the India ban, is due to operational requirements and affects flights bound for Lahore and northern destinations.

On Friday, the closure led to minor delays for both domestic and international flights, with several departures rescheduled to avoid the two-hour shutdown.

The Federal Investigation Agency (FIA) reported that its immigration counters remained fully functional, processing nearly 2,847 passengers from 12 international flights within three hours. Despite the congestion caused by simultaneous departures, screening and clearance were completed efficiently, and the agency reaffirmed its commitment to preventing human trafficking and intercepting wanted individuals.

Financial Resilience in Pakistan’s Aviation Sector

The Ministry of Defence stressed that the Rs4.1 billion figure represents a shortfall in overflight revenue rather than overall financial losses. Importantly, overflight charges remain unchanged, and no government bailout or tariff increases have been required.

In 2019, the average daily overflight revenue stood at $508,000, but by 2025, it had risen to $760,000 before the ban. The ministry suggested that this higher baseline, along with diversified airline traffic from non-Indian carriers, has cushioned the blow.

Moreover, Pakistan continues to earn from aeronautical services, terminal charges, and international departures—streams unaffected by the India-specific ban.

Strategic Calculations Over Economic Costs

While some economists question whether Pakistan should risk losing billions in overflight revenue, officials argue that the diplomatic and strategic messaging outweighs the financial costs. Blocking Indian access to Pakistani airspace serves as a reminder of the geographical leverage Pakistan holds in regional aviation routes.

Aviation policy experts note that the measure demonstrates Pakistan’s ability to use its airspace as a negotiating tool, without completely undermining its own aviation economy. This balance contrasts with India’s heavier operational losses due to rerouted flights.

Outlook and Possible Scenarios

As of now, the ban has been extended until the last week of August. Possible future scenarios include:

Extension of the ban if diplomatic relations remain tense.

Partial reopening for specific routes under confidence-building measures.

Complete reopening if bilateral negotiations show progress.

Travel industry insiders believe that even if the ban continues, Pakistan’s international flight sector will remain resilient, especially as demand for travel to the Middle East and Europe stays high. The real test, however, will be whether Indian carriers can sustain the extra operational costs without passing them on to passengers in a way that hurts demand.

Pakistan’s airspace closure to Indian-registered aircraft is a classic example of strategic diplomacy meeting economic reality. While Pakistan has accepted a manageable shortfall of Rs4.1 billion, India’s aviation sector is facing disproportionately higher losses due to longer and costlier flight paths.

For passengers in Pakistan, online flight booking options remain robust, and international flights from Pakistan continue largely unaffected—proof that the country’s aviation sector is better prepared this time compared to previous airspace closures.

As the standoff continues, one thing is clear: airspace is not just about routes in the sky—it’s a critical element of geopolitical strategy, where economic considerations often take a back seat to national sovereignty.

;More Travel News

-

05-Aug-2025Thailand Considers Visa-Free Entry for Pakistan – What to Expect

05-Aug-2025Thailand Considers Visa-Free Entry for Pakistan – What to Expect -

13-Feb-2020British High Commissioner Declared "Pakistan is Safe Country for Tourism"

13-Feb-2020British High Commissioner Declared "Pakistan is Safe Country for Tourism" -

08-Feb-2023UAE Launches New Visa Validity Extension Service Online

08-Feb-2023UAE Launches New Visa Validity Extension Service Online -

27-Feb-2020Due to Coronavirus Saudi Govt Banned Umrah Temporarily

27-Feb-2020Due to Coronavirus Saudi Govt Banned Umrah Temporarily -

21-Mar-2020Coronavirus: A Major Hit On Worlds’ Tourism

21-Mar-2020Coronavirus: A Major Hit On Worlds’ Tourism -

03-Feb-2026Top Mistakes Pakistanis Make While Booking Umrah Packages

03-Feb-2026Top Mistakes Pakistanis Make While Booking Umrah Packages -

.webp) 10-Jun-2025Philippines Opens New Global Gateways: Visa-Free Travel Expands for International Tourists

10-Jun-2025Philippines Opens New Global Gateways: Visa-Free Travel Expands for International Tourists -

02-Mar-2026How New Saudi Rules Affect Umrah Packages

02-Mar-2026How New Saudi Rules Affect Umrah Packages -

05-Nov-2025Budget Maldives Packages for Couples – Dream Getaway Under £1500 / PKR 500,000

05-Nov-2025Budget Maldives Packages for Couples – Dream Getaway Under £1500 / PKR 500,000 -

19-Feb-2026Economy Ramadan Umrah Package 2026: Your Essential Budget Guide

19-Feb-2026Economy Ramadan Umrah Package 2026: Your Essential Budget Guide -

03-Dec-2025Azerbaijan Visa Requirements for Pakistan 2026 – Step-by-Step Process

03-Dec-2025Azerbaijan Visa Requirements for Pakistan 2026 – Step-by-Step Process -

13-May-2025UAE Blue Visa: Your Sustainable Future Starts Here

13-May-2025UAE Blue Visa: Your Sustainable Future Starts Here